Making Tax Digital for Income Tax (MTD IT) – Your Complete Guide

The big change for sole traders & landlords is coming April 2026 – get ready the smart way

From April 2026, if your total income from one or more sole trader businesses and/or property income is over £50,000 in a tax year, HMRC will expect you to follow new MTD rules. Here's what that actually means in plain English.

Who's In Scope – The Rolling Thresholds

MTD IT is rolling out in phases, so it's worth knowing when it might affect you:

April 2026 – £50,000+ threshold

If you're a sole trader and/or landlord, you're in scope when your combined total from all these income sources exceeds £50,000:

✅ Self-employed income from one or more businesses

✅ UK property rental income

✅ Overseas property rental income

💡 Key point: It's your combined total – not per business. A freelance designer earning £30k + rental income of £25k = £55k total = MTD applies.

April 2027 – £30,000+ threshold

The threshold drops to £30,000 combined income, bringing in approximately another 600,000 people.

April 2028 – Everyone else

All remaining sole traders and landlords with any level of business or property income will need to follow MTD IT rules, regardless of how much they earn.

Partnerships – A Special Case

Partnership businesses (including LLPs) face a slightly different situation:

From April 2026: Partnerships with turnover over £50,000 will need quarterly MTD submissions

Individual partners are not currently in scope for their partnership income

However: If you're a partner who also has separate sole trader income or property income exceeding the thresholds, you'll need MTD for those non-partnership sources

The bottom line: Even if you're under £50k now, it's worth getting ready early. The threshold is dropping, and building good digital habits now means you'll be prepared whenever your turn comes.

Around 1.2 million people will eventually be using MTD IT once it's fully rolled out by 2028.

What Changes From April 2026

Instead of one annual Self Assessment, you'll need to:

📋 Keep digital records using approved software

📊 Submit quarterly updates – 4 times per year

📝 Complete a final declaration at year-end (replaces SA form)

Key dates for 2026-27:

• 7 August 2026 – Q1 update (6 Apr – 5 Jul)

• 7 November 2026 – Q2 update (6 Jul – 5 Oct)

• 7 February 2027 – Q3 update (6 Oct – 5 Jan)

• 7 May 2027 – Q4 update (6 Jan – 5 Apr)

• 31 January 2028 – Final Declaration

The quarterly updates aren't "mini tax returns" – they're simple summaries of income and expenses for that quarter. Tax adjustments happen at year-end.

Why Act Now – Not Later

The calm clients in April 2026 will be the ones who started preparing in 2025.

Starting early means:

No last-minute software panic

Time to build quarterly bookkeeping habits

Real-time visibility of your tax position throughout the year

Confidence that everything's set up correctly

What You'll Need – The Software Bit

You'll need MTD-compatible software that can connect to HMRC's systems. HMRC has committed to providing free software for straightforward cases (typically unincorporated businesses under the VAT threshold with no employees).

Xero Simple is our go-to solution for most sole traders and landlords – it's MTD-compatible and handles the majority of cases perfectly.

For more complex businesses, we'll assess your specific needs and recommend the best software package for your situation. Whether that's a different Xero plan or another provider – we'll guide you to what works best for your particular business setup.

(Spoiler alert: We have some strong opinions about certain popular options. Download our software guide to find out why QB Sole Trader might not be the best choice, despite what their marketing says.

Get Our Brutally Honest Software Guide by clicking the button below

Our MTD IT Package – What's Included

✅ Complete bookkeeping (monthly or quarterly) OR checking service where you do your own bookkeeping

✅ All four quarterly MTD submissions

✅ Year-end final declaration

✅ Xero Simple software included – free for up to 3 months if you join by 31 Dec 2025

✅ Compliance monitoring – we track all deadlines

✅ Multi-business discounts available

For most simple businesses, we offer a fixed price of £125/month – whether we do your bookkeeping or check the work you've done yourself.

Additional charges apply for:

Businesses with more than 50 transactions per month across all bank, cash and other financial accounts (current account, savings, credit cards, Zettle, Stripe, etc. – they all count towards your quota)

Additional services: customer and/or supplier control, VAT returns, payroll, management accounts, etc.

We handle the day-to-day numbers that keep your business moving and the statutory compliance work HMRC requires. Your quarterly updates, final declarations, and other filings are all managed in one place. You get up-to-date numbers you can act on now, without waiting months after year-end.

Pricing & Xero Simple Offer

Free Xero Simple periods:

Join by 31 Dec 2025 = at least 3 months free

Join in Jan 2026 = up to 3 months free

After the free period, Xero Simple will be priced at £7 + VAT/month (£8.40 for non-VAT registered businesses) – Xero's guarantee from MTD IT commencement. We'll let you know if Xero changes their pricing after that date, as other packages in the range are being updated soon.

Multi-business discounts:

2nd business: 20% off

3+ businesses: 20% off all

How This Affects Your Sector

🏗 Construction & Trades

Stay focused on your projects while we handle MTD compliance. We understand CIS, Domestic Reverse Charge, and construction-specific deadlines. Perfect for multi-crew operations.

🍽 Catering & Hospitality

No more missing deadlines during your busy Christmas or wedding seasons. We manage your books whether you're contract catering, running events, or operating mobile units.

🎨 Creatives & Marketing

Focus on your creative work while we handle the irregular project income and multiple revenue streams that make freelance life complicated.

Exemptions – Who Doesn't Need MTD IT

You may be exempt if you're digitally excluded due to age, disability, location, or religious grounds. Foster carers and those without National Insurance numbers are automatically exempt.

You can apply for exemptions through GOV.UK, but you'll need to reapply if circumstances change.

Next Steps – Your MTD Fast Start

Book your MTD Fast Start Call and we'll:

✅ Check if you're in scope based on your current income

✅ Set up your Xero Simple account with your free period

✅ Get your books MTD-ready before April 2026

✅ Plan your transition timeline so you're never rushing

🎁 Early Bird Benefits:

Join by 31 Dec 2025 = at least 3 months Xero Simple free

Terms & Conditions

Eligibility: Available to sole traders and landlords in scope for MTD IT (combined business/property income over relevant thresholds).

Free software periods: At least 6 months if joining before 30 Sept 2025; up to 6 months but at least 3 months if joining 1 Oct – 31 Dec 2025. All free plans stop on the 31st March 2026, and will be billed from 1st April 2026 with that month's retainer.

After free period: Xero Simple will be priced at £7 + VAT/month (£8.40 for non-VAT registered/flat rate scheme users) – Xero's guarantee from MTD IT commencement. We will notify you if Xero changes their pricing after that date, as other packages in the range are being updated soon.

Multi-business discounts: If there are 2 businesses to include the discount is 20% off the second business only; if there are 3 or more businesses to include the discount of 20% is taken off all businesses. Applies to sole trader and property businesses only. This does not include the cost of the software.

Service requirements: MTD bookkeeping must be managed by us for compliance. Additional charges may apply for catch-up work.

Your responsibilities: Supplying accurate, timely records. We handle statutory submissions, but you remain legally responsible for accuracy.

Anti-money laundering: We must perform anti money laundering searches before clients are fully engaged. If they fail, the first month's retainer will act as a service fee for carrying out these checks.

Cancellation: Two month's written notice required.

PLEASE SEE YOUR LETTER OF ENGAGEMENT AND PROPOSAL DOCUMENTS for scope and further clauses

Ready to get started?

📞 Book your MTD Fast Start Call now!

Or, please kindly fill out the form below and we'll get back to you as soon as possible

Why Parks Bookkeeping Services?

Having seen our parents lose their business (and our family home), as well as having to suffer bankruptcy during the 1990 recession, Ian and I are both extremely passionate about helping small business owners achieve their goals, provide for their families and make sure that they are in the best position they can be in order to pay their taxes on time and weather any future storm by recession proofing their business.

Think of us as your safety net. We will always respect your ideals, offer help and assistance where we can and make sure that your life and work are both stress free.

Kim Parks, Senior Partner

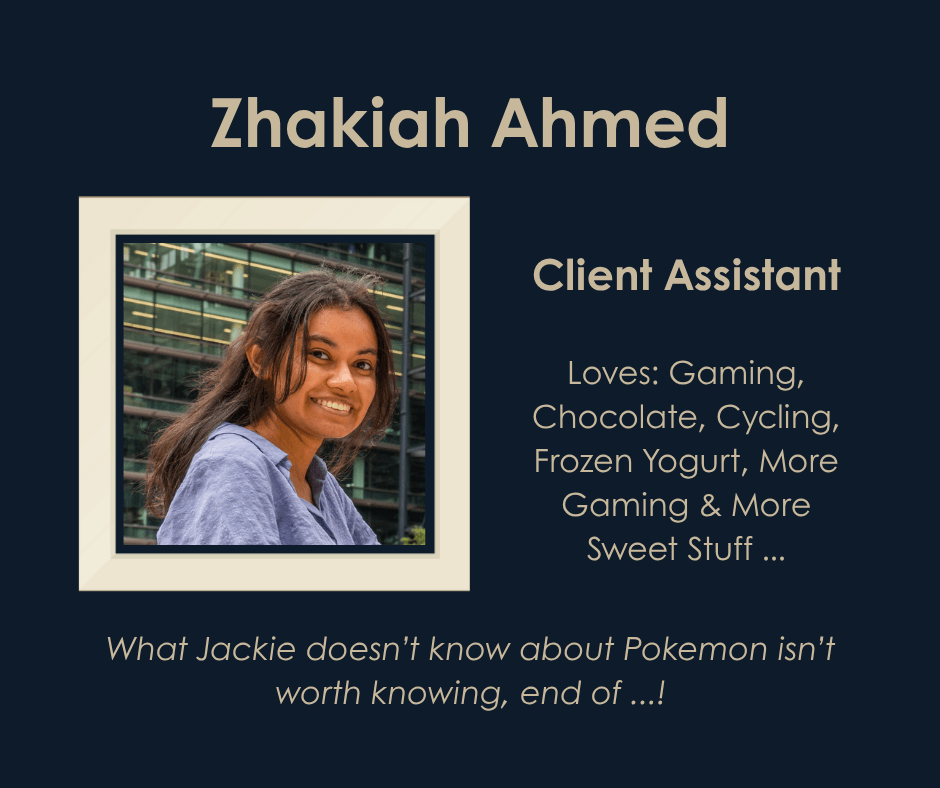

Some of our partners